Why does my spouse need to sign the deed?

One to buy and two to sell.

This is one of the most common phrases we hear thrown around about what is required in terms of signatures on deeds and deeds of trust in North Carolina. While it is a very good baseline rule, figuring out who has to sign documentation oftentimes requires a more complex analysis than the simple phrase. This article is going to explain who needs to sign in various situations, and importantly, WHY that signature is necessary under NC law.

We start with a disclaimer: the information that follows provides a general set of rules about signatures but is not applicable in every case. If you find yourself in a situation where you are not sure about signatures, please talk to your real estate attorney! You can always call (336-904-3001) or email (info@atlas-orange.com) our office and ask to be sure. We frequently run into situations where even licensed attorneys get tripped up about who has to sign. There is a lot of misinformation about this particular topic, and you should never rely on something you read online. The purpose here it to help you understand the rules and why a spouse would need to sign.

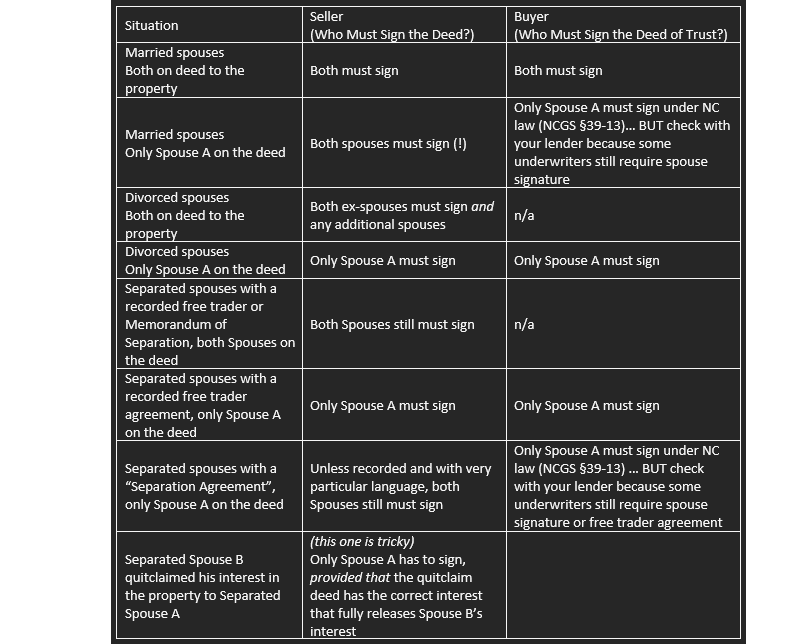

That said, here is your basic chart to help give you a jumping off point:

Important point to make here… “legally separated” is the same thing as “married” for the purposes of North Carolina real estate law. If you are legally separated in North Carolina, you are still considered married until the divorce decree is finalized. This is even true if there is a separation agreement in place with language that specifically says what is supposed to happen with the property in question. Those separation agreements do not legally divest the disadvantaged spouse of their interest in the property, so it is critical that you have a family law attorney who knows what they are doing when they work through real property issues in your divorce or separation.

Why? Why does the spouse have to sign when they don’t own the property?

The incorrect answer here, which is very common to hear, is that the spouse has a “marital interest” or “marital right” or (even worse) “community property right” in the property. Thinking about the situation where Spouse A is on the deed to the property, but Spouse B still has to sign the deed, the reason is not because Spouse B has some kind of equitable or actual interest in the property that is related to the fact they are married. Even if Spouse B has made mortgage payments on the property for the last thirty years, Spouse B does not have an actual vested interest in the property absent a court order that says otherwise.

The right is not a legal or equitable vested interest in the property. The fact that the spouse has to sign has nothing to do with their ability to make a claim to interest in the property or to say that they are married, therefore, they should get a division of the proceeds from the sale. It is a contingent interest—what we call in our office (cause we fancy) an inchoate interest. The spouse’s right to the property does not vest unless and until the owner of the property dies. Yikes, what?

North Carolina General Statute §29-30 provides that “in lieu of the intestate share … the surviving spouse … is entitled to take … a life estate in one third in value of all the real estate of which the deceased spouse was seised and possessed … at any time during coverture.” This means that a surviving spouse is entitled to a life estate in one-third of the value of any real estate owned while the spouses where married. The statute specifically provides that the spouse’s joinder on an instrument conveying the property will effectively waive their right to make the claim as to that property. In other words, if the spouse signs the deed, they can not come back and claim their share under §29-30 later.

This statute originates in the days of “dower and curtesy”—these were common law doctrines that protects the spouse’s rights to get the property of their spouse, even if their spouse desired otherwise. This author thinks that rule is antiquated and frustrates the purpose of intentional estate planning in almost every case it is invoked, but nobody asked this author their opinion about it anyway.

What this means for you.

If you are a listing agent working through a separation context, before you do anything, pull a copy of the deed from the register of deeds. Let us know if you need help! Note who the grantee is on your “vesting deed”—if both spouses are there, both spouses have to sign. If only one spouse is on, they will definitely have to sign, but you have to ask more questions to determine whether the other spouse is going to be in play.

Find out the status of the separation. Once divorced, the ex-spouse cannot make a claim under §29-30, so the finalization of the divorce can save the day. Also, if your client is working with an attorney, start asking questions about pre-marital (pre-nuptial) agreements, recorded memorandums of separation, or free trader agreements. Any one of those three will oftentimes (not always) waive the inchoate interest under §29-30.

Even if you aren’t in a separation situation, or you have separated spouses who are amicable, I recommend getting signatures from a non-owning spouse on listing agreements and OTPs, if you can. If you have them on board early in the process, it almost always ensures that they will be on board later in the process (and they are contractually encouraged to go with the program). Remember that situations between spouses can change, and oftentimes live events like selling a piece of property can be paired with marital upheaval/strife.

As always…

Ask questions early and often, whether you are a buyer or seller, if you are concerned about signatures. Last year we had a separated seller spouse sell everything, abandon the family, and move to India, never to be seen again. The property was quitclaimed from the absent spouse, but the deed did not have any language divesting the spouse’s right under §29-30. A correctable problem, but not necessarily a quick fix—having that conversation with your seller at the time of listing is much easier than the week before closing.

Remember, you have a team in your corner ready to help answer questions and solve problems. Part of what makes a great real estate agent is being able to identify a problem and point clients to someone who can help them solve the problem. When you see it, call (336-904-3001) or email (info@atlas-orange.com) us for next steps!